Payroll giving

What is payroll giving?

Payroll giving is a way of donating to charity through your salary. It is also sometimes called ‘give as you earn’.

Donating in this way is hassle-free and you don’t have to share any bank details.

The best thing about payroll giving is that you donate before you pay tax. This means that your donation costs you even less!

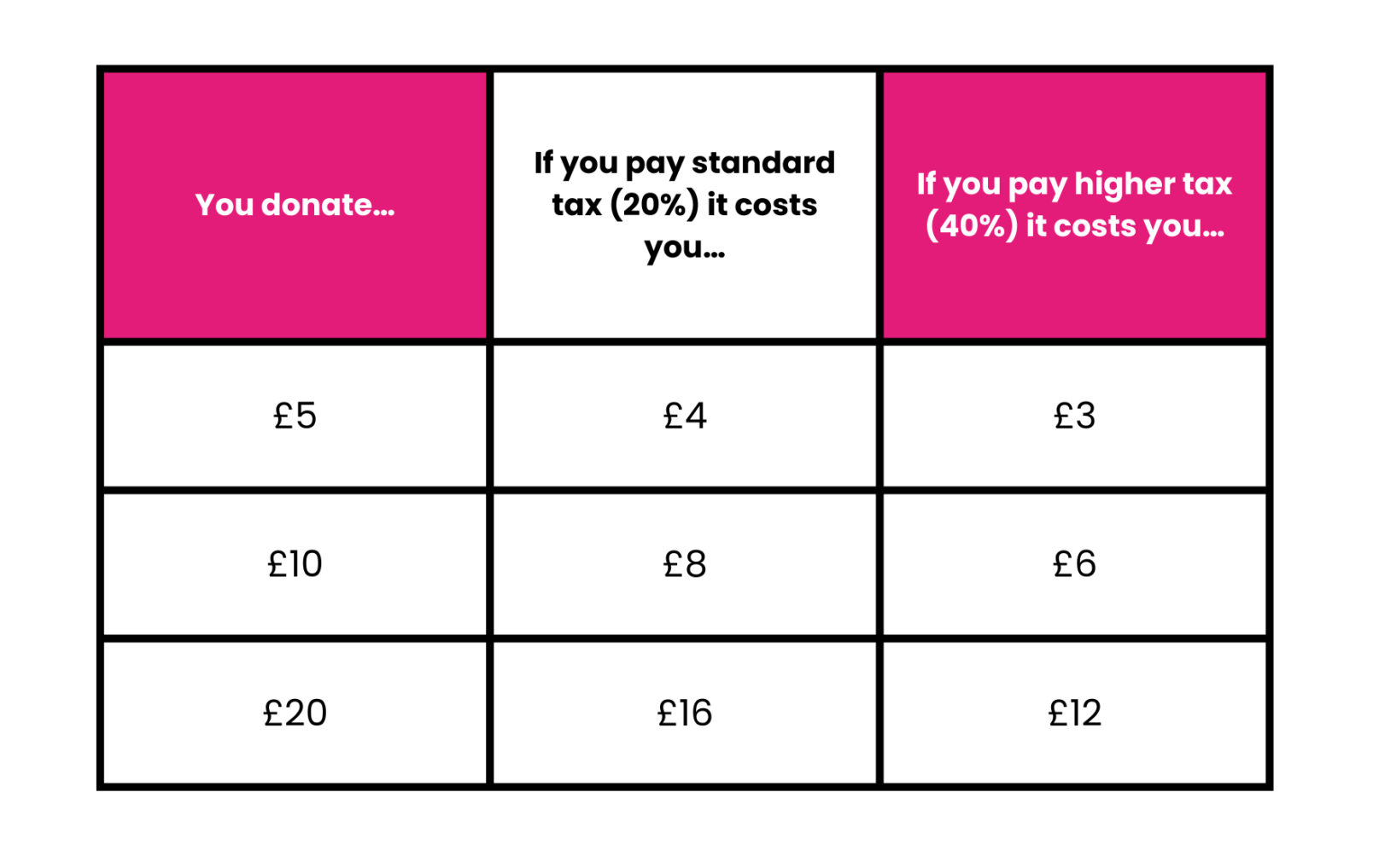

For example:

If you wanted to donate £10 to SignHealth, £8 would be deducted from your pay and the taxman would pay the additional £2 – so SignHealth would receive the full £10.

If you pay a higher tax rate (e.g. 40%), you would only pay £6 and the taxman would pay the additional £4!

How much can I donate?

If you choose to donate through payroll giving, you have full control over how much you would like to give. There is no minimum or maximum amount. You can choose to donate for as long as you like and you can cancel any time.

How do I sign up?

The first step is to check with your employer to make sure that they offer payroll giving. If they do, they will help set it up.

If your employer does not currently offer payroll giving. You can write to them and ask them to set up a payroll giving scheme. They will need to register with an approved agency:

https://www.gov.uk/government/publications/payroll-giving-approved-agencies

If your circumstances change and you want to change or cancel your donation, simply tell your employer.

If you change your job, your donations will not automatically transfer. You will need to start a new payroll giving scheme with them.

By donating through payroll, you directly help people like Danielle

Danielle* was living in fear of her ex-partner, who had abused her for years. SignHealth helped to make her safe and support her in rebuilding her life.

If you would rather make a regular or one-off gift in another way, you can donate here.